1 min read

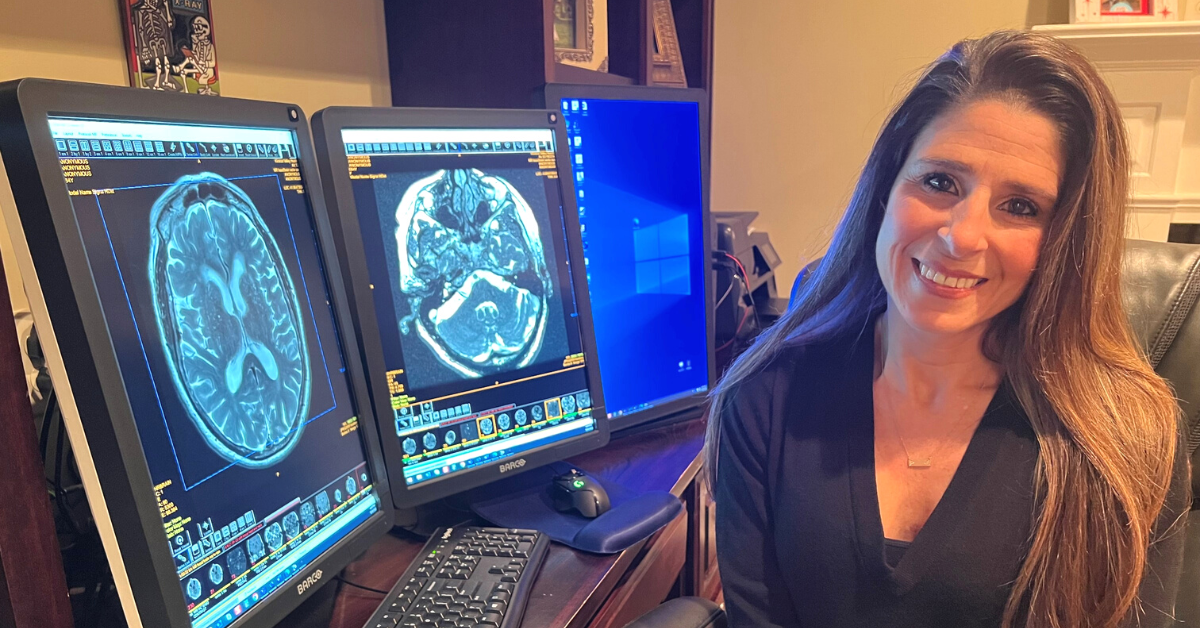

Q&A: vRad’s CIO on AI Beyond Worklist Prioritization, New Solutions for Radiologists, COVID-19 and More

For the latest information on vRad’s Artificial Intelligence program please visit vrad.com/radiology-services/radiology-ai/ Originally...

.jpg?width=1024&height=576&name=vRad-High-Quality-Patient-Care-1024x576%20(1).jpg)

%20(2).jpg?width=1008&height=755&name=Copy%20of%20Mega%20Nav%20Images%202025%20(1008%20x%20755%20px)%20(2).jpg)

.png)